MortEq Lending Corp. (“MortEq”) is a mortgage investment corporation incorporated under the Business Corporations Act (British Columbia) on November 16, 2006. MortEq will seek to generate an internal rate of return to investors of 6.5 to 10% net of fees and expenses, by investing in first, second and third mortgages in the Province of British Columbia & Ontario that do not meet conventional lending requirements. MortEq invests in first, second, and in exceptional cases third mortgages on residential properties such as single-family dwellings, duplexes, townhouses, condominium units, land or multiple family dwellings such as apartment buildings, including properties under construction. MortEq also invests in mortgages on commercial and industrial properties including properties under construction. The Company invests in Mortgages British Columbia & Ontario for a short term period.

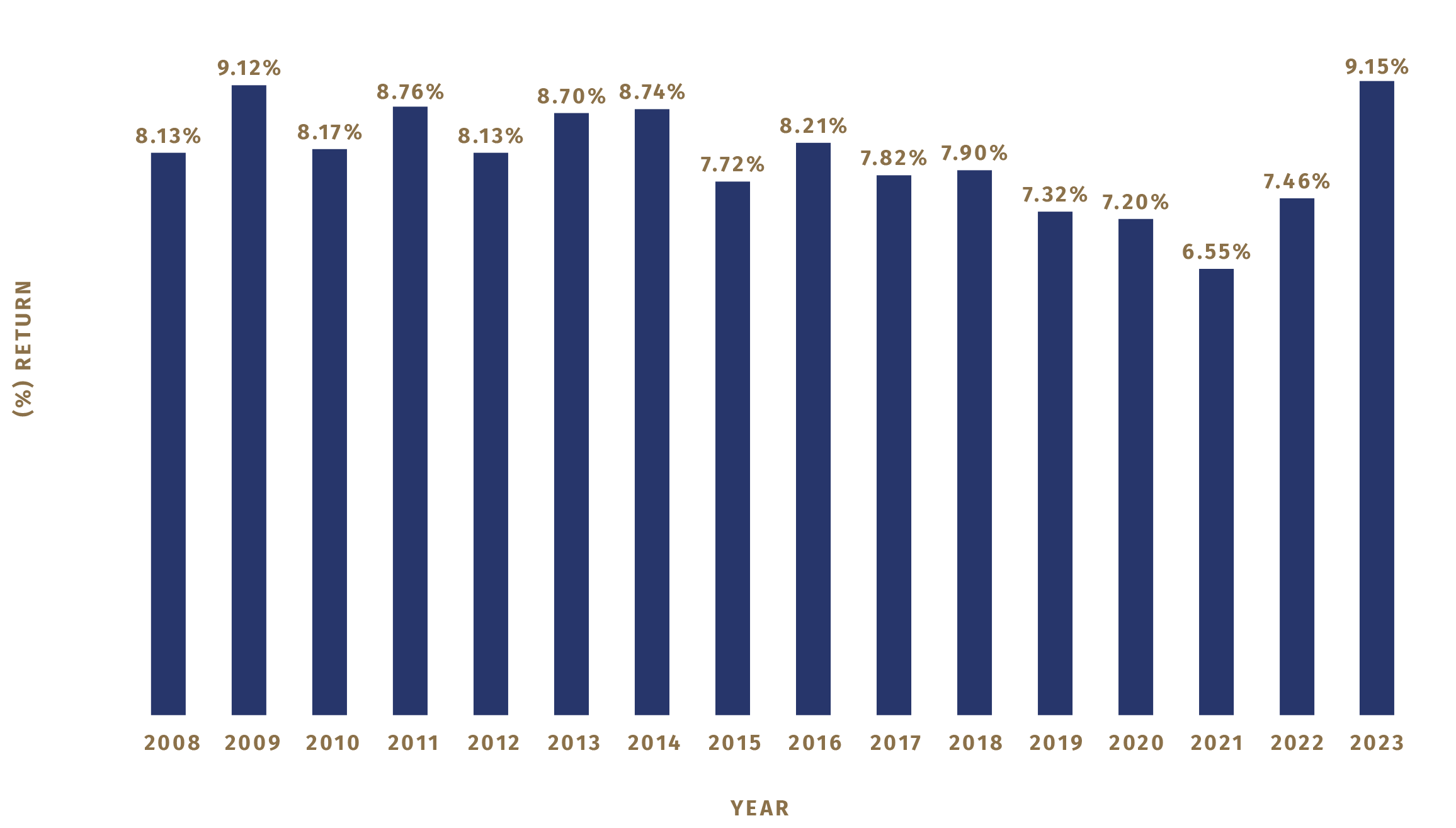

PHL has generated steady, consistent growth and returns since its inception in 2007. We expect demand for private mortgage financing will remain high in our region as ‘“conventional” lenders such as banks, credit unions and trust companies continue to tighten lending policies.

Past results are not indicative of future results. Please read the offering memorandum before investing.

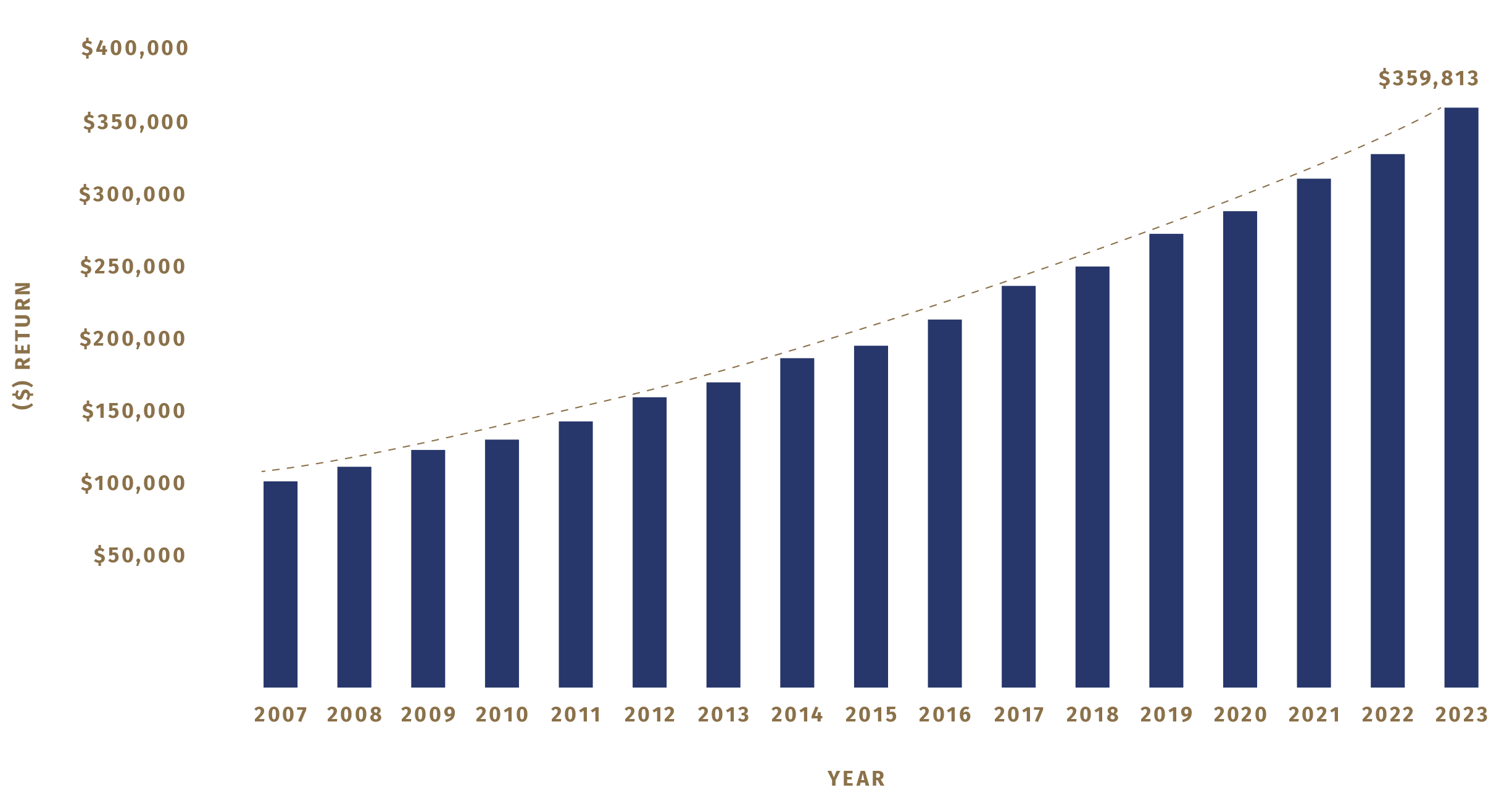

The chart above illustrated the growth of a $100,000 investment since inception with compounding quarterly dividends only and no additional contributions. Past results are not indicative of future results. Please read the offering memorandum before investing.

Shareholders will be entitled to receive dividends on a quarterly basis. Dividends may be taken as cash or reinvested as additional shares. Dividends reinvested as additional shares will qualify for future dividends.

Dividends are paid out as follows:

Q1

Sept 1 – Nov 30

Dividend paid out by Dec 31st

Q2

Dec 1 – Feb 28

Dividend paid out by Mar 31st

Q3

Mar 1 – May 31

Dividend paid out by June 30th

Q4

June 1 – Aug 31

Dividend paid out within 90 days of fiscal year end

PHONE604-579-0844

EMAIL[email protected]